Over the past few months, I have been asking a key question: how long can a few sectors continue to power the U.S. labor market? January’s employment data is beginning to provide some answers.

To start with, US employment continues to rise more than expected. The Bureau of Labor Statistics reported this morning that total nonfarm payroll employment grew by 353,000 jobs in January. Economist had predicted that payrolls would increase 177,000. Payrolls in intangible producing sectors rose by 224,100. In contrast, employment in goods producing sectors was up only 28,000 (23,000 in manufacturing) and tangible services increased by 100,400.

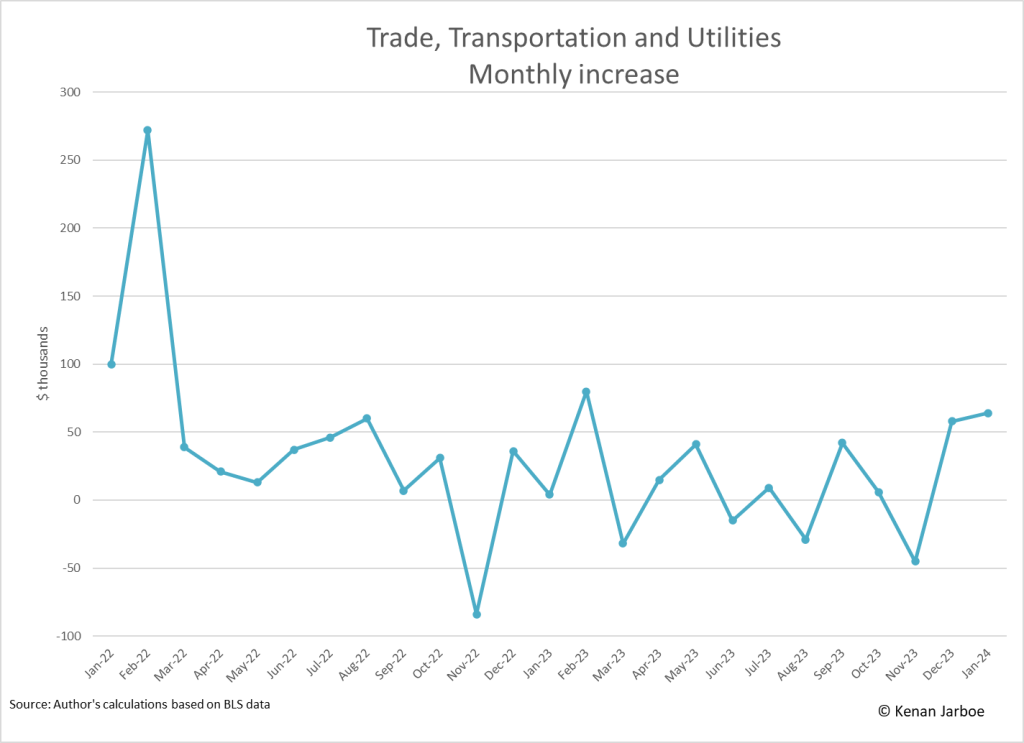

The biggest surprise however came in the shift in which sector were leading the job gains. Educational & Health Services (excluding tangible services) continued to grow, adding a huge 90,400 jobs. And Government (excluding Postal Service) was up by 31,500. But payrolls in the tangible-producing Accommodation & Food Services sector declined by 5,500. In a couple of turnarounds, Trade, Transportation & Utilities added 64,000 jobs and Professional & Business Services (excluding tangible services) grew by 60,700 jobs.

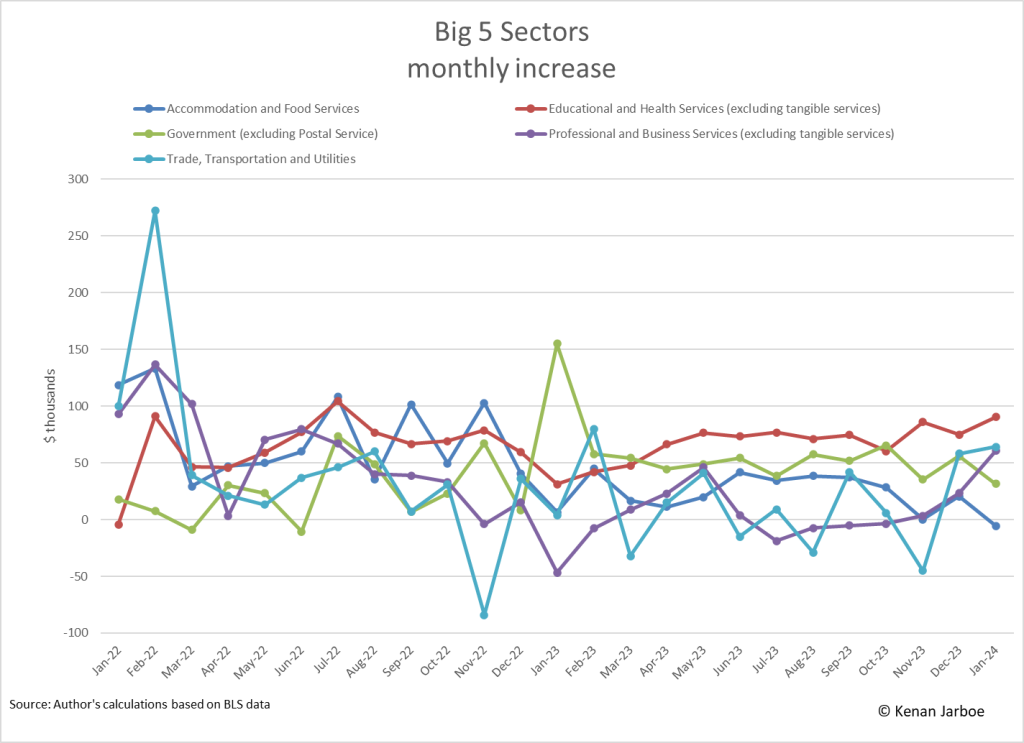

As the charts below show, what we a seeing is continued growth in the key sectors of Educational & Health Services and Government combined with some shifts in other areas. Growth in Accommodation & Food Services has been trending downward and may have peaked. Meanwhile, Trade, Transportation & Utilities and Professional & Business Service have gone up and down and are currently up. We will see over the next few months whether today’s numbers are just a fluke or a true sign of a shift in the economy.